The lid is heating up

Dec 10, 2024

China pops while tech drops and M&A activity jumps

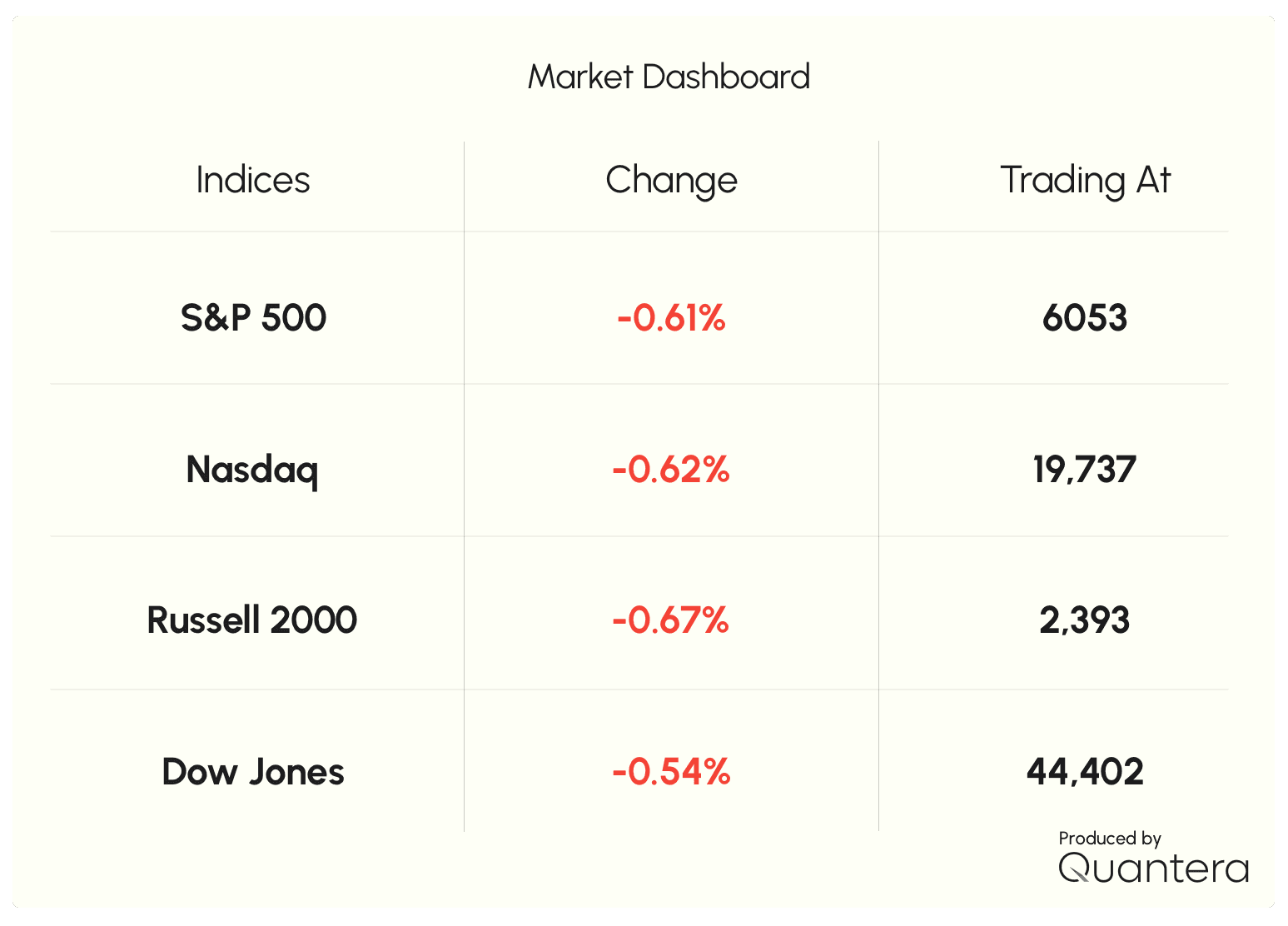

Indices: All four major U.S. benchmarks finished lower today, breaking a multi-week pattern of steady gains.

Sectors: Just 2 of the 11 S&P 500 sectors ended green, with Healthcare (+0.29%) holding up best and Communications (-2.13%) struggling.

Sentiment: The day showcased a tug-of-war between upbeat international developments and profit-taking in overheated domestic markets.

Most Bullish Symbols: $HUIZ, $OLLI, $CMRX, $DUO, $SONN

Most Bearish Symbols: $HSY, $RTX, $TMUS, $CRSP, $PARA

Global Catalysts & Mixed Reactions:

China’s Stimulus Push: Beijing announced plans for “more proactive” fiscal and monetary support to revive consumer spending. This sent Asian markets soaring overnight and sparked early optimism in the U.S.

Inflow to Chinese Names: ETFs like $MCHI and large-cap Chinese tech stocks (Alibaba, JD.com, PDD, Baidu) rallied, momentarily lifting sentiment across global equities.

Domestic Market Dynamics:

Initial Lift, Quick Fade: Early gains in U.S. stocks gave way as traders rushed to lock in profits. Palantir ($PLTR), up over 400% in a year, spiked at the open but swiftly reversed as momentum players took money off the table.

Semiconductor Setback: A new antitrust probe in China targeted Nvidia’s past acquisition of Mellanox. Meanwhile, Bank of America’s downgrade of AMD to Neutral, citing rising competition and delayed AI offerings, further weighed on chipmakers.

Context & Outlook:

Healthy Cooling or Warning Sign? After weeks of upward momentum, today’s pullback may represent normal consolidation—or the start of investors rotating out of crowded trades.

Tops as Processes, Not Points: Market tops rarely happen in a single session. With year-end adjustments and a host of geopolitical and regulatory uncertainties on the horizon, expect ongoing volatility as portfolios are realigned ahead of 2025.

Bottom Line:

Global optimism from China’s stimulus efforts initially spurred hopes for another rally leg, but reality set in when profit-takers and regulatory clouds descended on U.S. tech. As we move into the final stretch of the year, investors appear keen to rebalance and reassess in a market no longer uniformly marching higher.

Insights Blog

READ MORE