Potential Red Flags

Dec 6, 2024

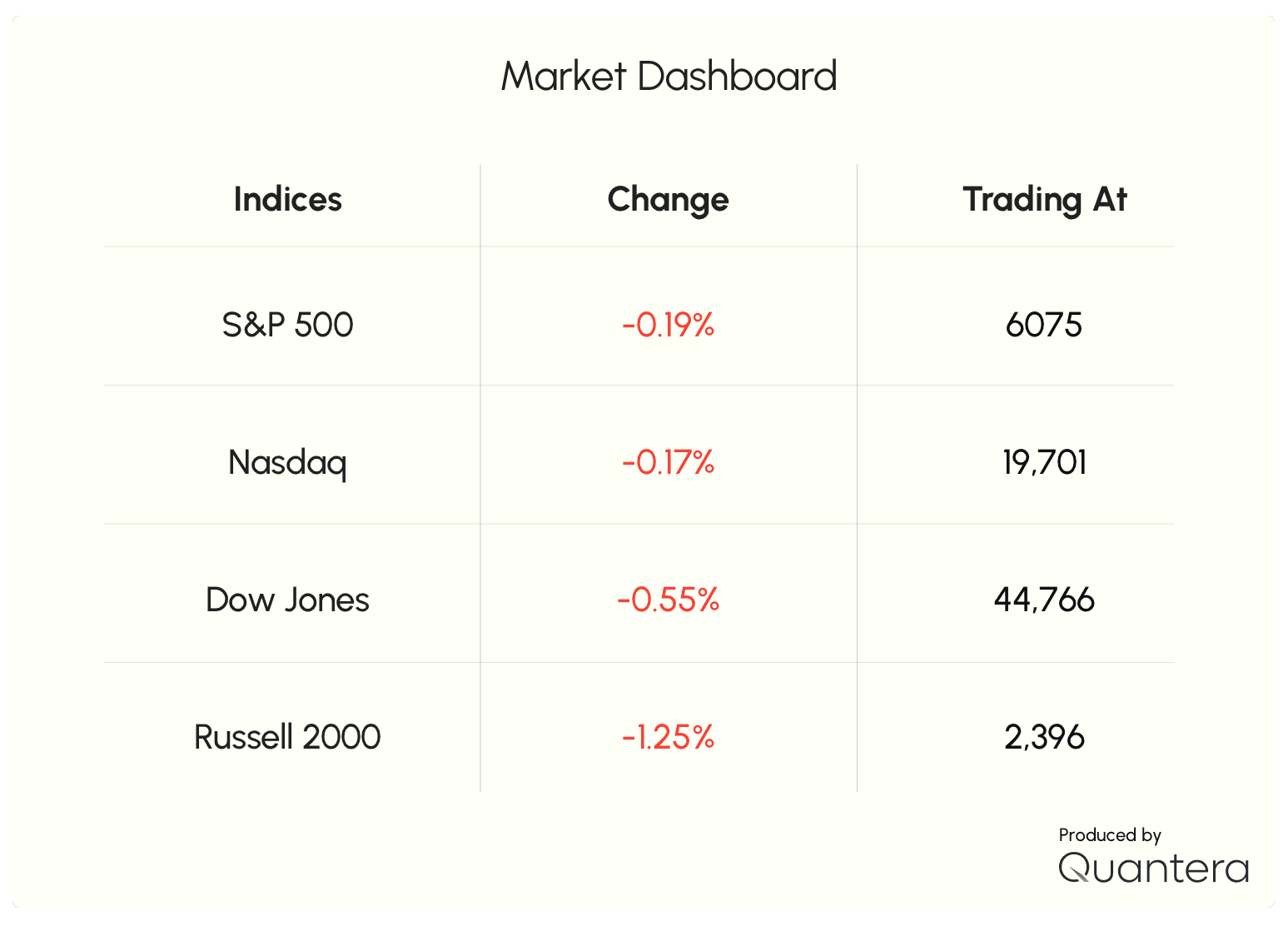

U.S. Markets Hit A Speed Bump, Airline Stocks Gain Altitude, And Traders Eye Crypto’s Next Move Key Takeaways: 5 Dec, 2024 Indices: Broad-based decline after a strong run, with mega-cap tech finally dipping in line with recent small-cap weakness. Sectors: 5 of 11 closed green; Consumer Discretionary (+0.82%) outperformed, while Materials (-1.32%) lagged. Crypto: Bitcoin broke below $100k after hours, adding volatility heading into Friday.

Airlines Ascend On Upgrades & Guidance

American Airlines: +17% on raised Q4 guidance and robust travel demand.

Sector Sentiment: Analyst upgrades and cost controls driving multiple airline names to new cycle highs.

Investor Takeaway: Traders see more runway ahead

Notable Market Themes & Signals

Reversal Risk: S&P 500 ($SPY) under scrutiny; chart watchers note a potential reversal setup after today’s downturn.

Momentum Favorites: Names like SoundHound ($SOUND) are hitting record volume, while other stocks ($AMAT, $NVDA, $RBLX) test key technical levels.

Crypto Tokens: $SUI.X in focus for next leg higher, while Bitcoin’s post-$100k volatility tests conviction in the digital asset’s uptrend.

Macro & Thesis

Shifting Dynamics: After a streak of relentless gains, the market’s first unified pullback signals investors pausing to reassess valuations and recent economic data.

Selective Strength: Airlines and certain breakout stocks thrive despite broader weakness, indicating pockets of resilience.

Forward Look: As we near year-end, earnings, guidance adjustments, and thematic plays (like crypto and AI-driven strategies) will likely shape investors’ next moves.

Insights Blog

READ MORE