Markets Marches Higher

Dec 5, 2024

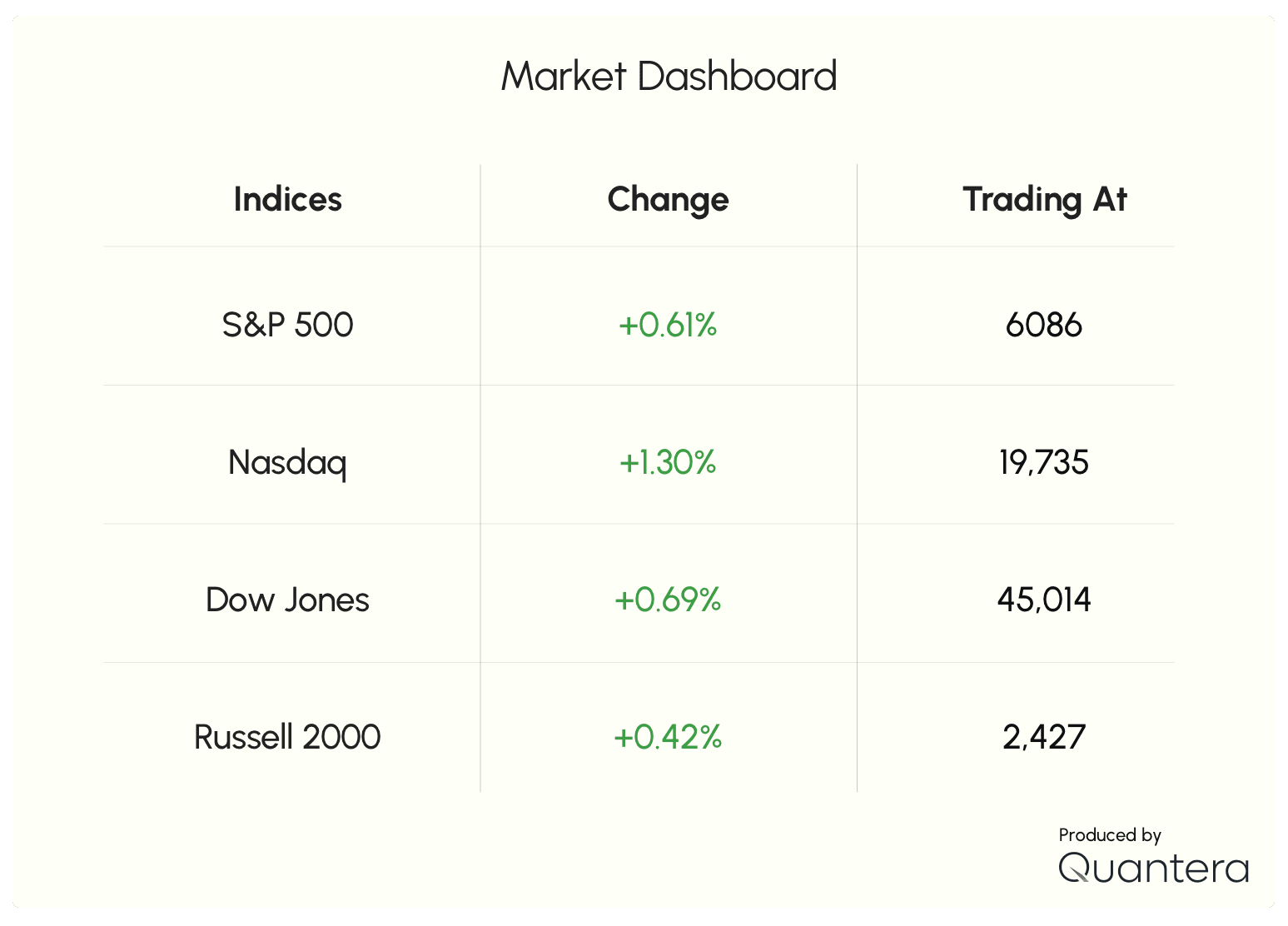

Key Takeaways from 4 Dec, 2024: Indices: All major U.S. benchmarks rose, with the S&P 500 hitting its 56th record high of the year. Global Share: The U.S. now represents 63% of the global market cap, up from 60.5%. Sector Spotlight: Tech leads (+1.83%) and Energy lags (-2.41%). Crypto: Bitcoin flirts with $100k; altcoins pass $1.15 trillion total market cap

Sector Leaders / Laggards:

Winners: Technology (+1.83%), Consumer Discretionary (+1.0%)

Losers: Energy (-2.41%), Materials (-0.5%)

U.S. Market Dominance

U.S. stocks are currently the top choice for risk-taking investors worldwide. A key reason for this dominance is the U.S. technology sector. It has the largest influence on major indexes and has outperformed every other industry since the financial crisis. Now, it’s hitting new highs once again.

Global Market Share: U.S. at 63% vs. Japan at 5.6% - Ongoing inflow of international capital into U.S. equities

Drivers: Corporate earnings resilience, supportive monetary, and secular tech leadership

Tech at the Helm

U.S. stocks currently reign supreme in the global arena of risk assets, attracting more capital and attention than any other market. Central to this strength is the technology sector, which holds the largest share of major U.S. indices and has delivered exceptional returns since the financial crisis. Now, with key tech names soaring, this sector is once again breaking through its previous peaks, signaling that the U.S. growth story may still be far from over.

$XLK (Tech ETF): Broke above July highs, confirming fresh all-time highs

Leaders: Apple (All-time highs), Semiconductors (Rebounding post-earnings)

Late Arrivals: Stocks like Square ($SQ) now catching up as managers seek new opportunities amid lofty valuations elsewhere

Macro Backdrop & Thesis

Environment:

Inflation stable enough not to derail growth

Consumer confidence is firm, supporting discretionary spending

Policy environment largely supportive of risk assets

Thesis:

U.S. equities remain the top choice for global investors seeking growth, liquidity, and innovation

Technology’s new highs and crypto’s milestones underscore a “risk-on” mindset that transcends traditional boundaries

Breadth improving as smaller names participate, reducing concentration risks and extending the rally’s potential longevity

Bottom Line:

U.S. markets continue to power ahead, supported by impressive earnings, global capital inflows, and leadership from tech. While valuations run high, the willingness of investors to buy breakouts and seek fresh opportunities keeps pushing the envelope. With crypto ascending alongside equities, the current cycle is defined by broad risk appetite, data-driven gains, and a seemingly unstoppable trend to new frontiers.

Insights Blog

READ MORE