It’s time for the Big Guns

Dec 9, 2024

Labor market cracks, the S&P 500's quarterly shakeup, and the Nasdaq's favorable SMCI ruling.

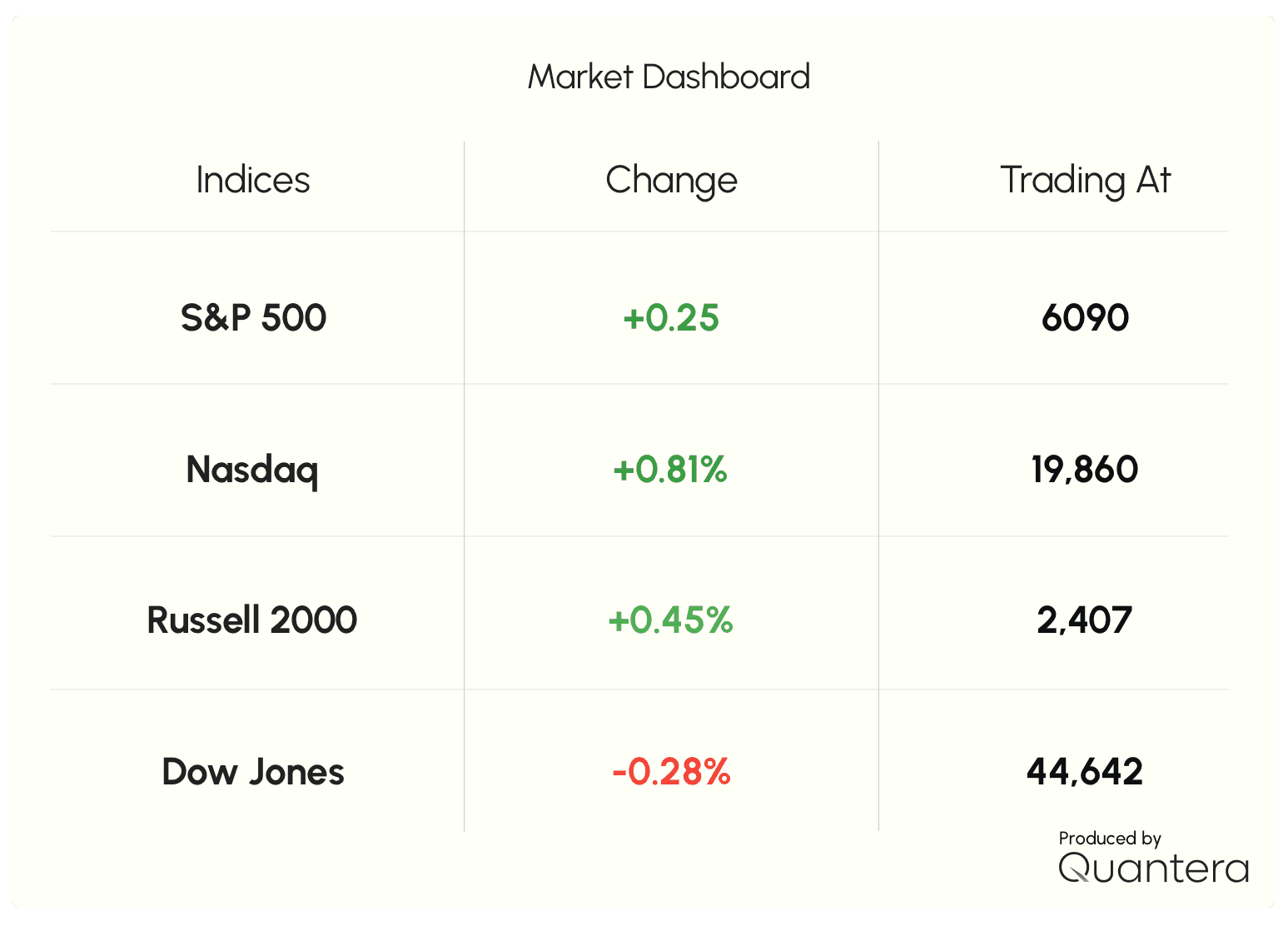

Sectors: 3 of 11 closed green; Consumer Discretionary (+2.11%) led, Energy (-1.70%) lagged.

Notable Movers: Mega-Caps: Amazon & Meta hit new all-time highs; Tesla nears 2021 peak.

Most Bullish Symbols: $CXAI, $ALBT, $GWRE, $BIOA, $LIFW

Most Bearish Symbols: $OSK, $RBLX, $REI, $PR, $SWBI

Market Sentiment: While the major indexes remain mixed, certain tech stocks continue to thrive. Mega-cap outperformance fueled gains for risk-takers, who may be locking in profits as the weekend approaches.

Jobs Market Rebounds, But Cracks Show

November Nonfarm Jobs: +227k vs. +200k expected; previous months revised higher.

Unemployment Rate: Increased to 4.2% as labor force participation dipped.

Job Quality Concern: Analysts highlight that many gains were from strike-returnees and concentrated in a few sectors (healthcare, government, leisure & hospitality).

Employment Trend: YoY change in employment turned negative for the first time since 2010 (excluding Covid), historically a recessionary signal—though “this time may be different.”

Wages: Average Hourly Earnings +0.4% MoM, +4% YoY, both 0.1% above expectations.

Fed Watch: The probability of a rate cut jumped from 70% to 85%, suggesting markets are pricing in policy easing at the Fed’s final 2024 meeting in two weeks.

Bottom Line:

Mega-caps keep powering forward, lifting some of tech stocks despite mixed broader indices. The labor market’s subtle cracks suggest a slowing economy, while wage growth still outpaces inflation. With the Fed likely cutting rates soon, investors remain in a data-dependent stance, looking for clear signals on whether markets push higher or take a breather.

Insights Blog

READ MORE